aih capital(Pty) ltd

"uplift and impact women through our investment choices."

AIH Capital is the fund manager of AIH Fund I, a generalist private equity fund focused on the mid market. The majority shareholder of AIH Capital is AWCA Investment Holdings, a 100% black woman owned company with over 50 black women shareholders who are mainly CAs. AIH Fund I makes equity-related investments in companies that are primarily mid-sized and privately held. Portfolio companies are in various industries, exhibit quality operations and strong management, with attractive growth and return prospects. We drive women empowerment through our investments.

AIH Capital will be a key catalyst for increasing the participation of women in the economy. This will be achieved through leveraging their competitive advantage of a unique combination of demonstrated strength and depth and breadth of skills in investments, governance and financial management. The Fund Principals also boast broad networks, collaboration, value chain optimisation and inclusivity to pursue and make Investments in various sectors.

The remaining shares in AIH Capital are currently held by the Fund Principals. Through AIH, AIH Capital will provide an opportunity for professional women, who are mainly Chartered Accountants across all levels (entry-level to experienced) to indirectly invest in an alternative investment vehicle which will grant them exposure to private assets that they could not otherwise access.”

aih capital

Board of Directors

Ms. Sindisiwe Mabaso- Koyana

CA(SA)

(Managing Partner)

Ms. Jesmane Boggenpoel

CA(SA),

(Chief Investment Officer)

Mr. Sean Dougherty

CA(SA)

(Non- Executive)

aih capital

Key Sectors

Financial Services

The Financial Services industry is a key driver for financial inclusion. Investing in this sector and fin-tech in particular ensures access to finance of black people as well as women. Even at a shareholding and management level, this industry has remained male dominated and our investing will ensure its transformation.

Industrial (In energy transforming companies)

Our country's economic growth is dependent on industries where we manufacture and beneficiate including healthcare. This contributes to job creation. Whilst digitisation and technology is an enabler, the South African economy remains dependent on the utilization of large labour forces. We have seen large amounts of women at lower levels and our investments insure we see participation of women as shareholders and managers.

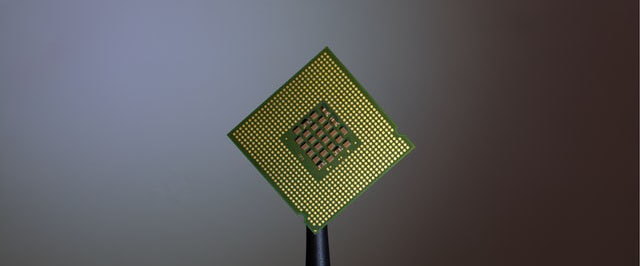

Technology/ Digitization

The advancement of technologies such as machine learning, artificial intelligence, and advanced robotics will have a far-reaching impact on South Africa’s workplaces. Although digitization will be disruptive, it has the potential to raise productivity and operational efficiency in businesses across sectors, to deliver better outcomes for both customers and citizens

Food & Agriculture

There is a big shortfall between the amount of food we produce today and the amount needed to feed everyone by 2050. There will be nearly 10 billion people on Earth by 2050—about 3 billion more mouths to feed than there were in 2019’s population of 7.7billion. Women have always been a contibuter to the rural and township economies as labour force investing in agriculture ensures ownership and leadership.

aih capital

Investment Committee

aih capital

The team

Ms. Sindisiwe Mabaso- Koyana

CA(SA)

Managing Partner

Ms. Jesmane Boggenpoel

CA(SA),

MPA Harvard

Chief Investment Officer

Ms. Precious Mgquba

CA(SA)MBA

Investment

& Operations Manager

Ms. Omphile Ntsoane

CA(SA)

Investment Associate

Ms. Kholo Makgoka

CA(SA)

Operations & Compliance Officer

Ms. Zanele Msimangi

Lead of ESG and Compliance

Ms. Zanny Mthalane

Office &

Admin Manager

Awards and recognitions

Media

AIH Capital’s AIH Fund 1 acquires 49% equity interest in HDC

AIH Fund I, under the management of private equity fund manager AIH Capital, has closed a second deal with High Duty Castings (HDC), resulting in the fund now owning 49% of the manufacturing company...

Read More

SAVCA Women Empowerment Mentoring and Incubation Fund manager Programme

AIH Capital is proud to have been chosen to participate in the Women Empowerment mentoring and incubation fund manager programme for 2021.